Case study: Increasing engagement with User Accounts at Nerdwallet

Disclaimer: I'm not affiliated with NerdWallet, nor do I know about their business model beyond news coverage and inference.

NerdWallet helps people choose the right financial products for themselves. If the brand wants to have more personal interaction than "best credit card 2016," it needs to be part of people's larger financial journeys.

Goal and Challenge

How many 101 articles does someone have to read? What comes after what?

To measure increased WAU/MAU engagement, we should see users

- interact more with recommendation/assessment tools

- come back for help navigating a financial process

I hypothesize that providing more goal-oriented interactions instead of decision-oriented interactions will be more engaging. If you give people goals/tasks and a powerful reason to act on them, they don't have to think. Plus you can bring them back when they check their progress.

Metrics to move:

- increase repeat visits

- increase use of financial tools and chats with advisors

- increase interaction with how-to / serial content

Assumptions and concerns

Assumption: that people want to engage with NerdWallet more though a lot of their tools and content are for quick in-and-out visitors (hunch: based on traffic and followed up with retargeted ads)

Assumption: people want / need help setting financial goals or seeing the larger financial picture (because of services like Acorns, Mint, etc.) and they don't go to the bank for it

Concern: NerdWallet visitors might not be interested in anything more than quick comparisons

Why now is a good time

Insurance ecosystem map (Greylock Partners): potential partners, or at least a sign of what NW might need to help users navigate

Startups are hacking away at traditional financial institutions (banks, credit cards, insurance, etc.). Each service aims to provide a better user experience in that specific category, but traditional institutions still have bundling on their side. But if the market goes through a crunch and fintech startups start aquiring one another, they have a chance to to threaten institutions' market share.

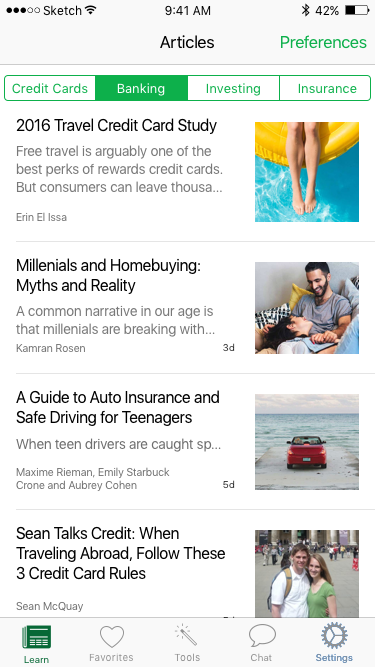

A lot of people visit NerdWallet because they want to find the "best rewards card for 2016" and compare loans and plans. And NerdWallet presents a lot of informative content, like Credit Cards 101 and What's My Credit Score. But how do I know what content I need at this moment? How do I know what I've read? And how will I get recommendations that are personalized to my experience based on the financial products I use now (or have expressed interest in)?

strategies to increase user engagement

- User accounts

- Produce more content, including serial content (including video + email courses)

- Feature tools and chat with financial advisors more prominently

- Capture user emails more effectively for targeted drip campaigns

- Guest blogging + user-generated content

one Solution

Customers / users would benefit from:

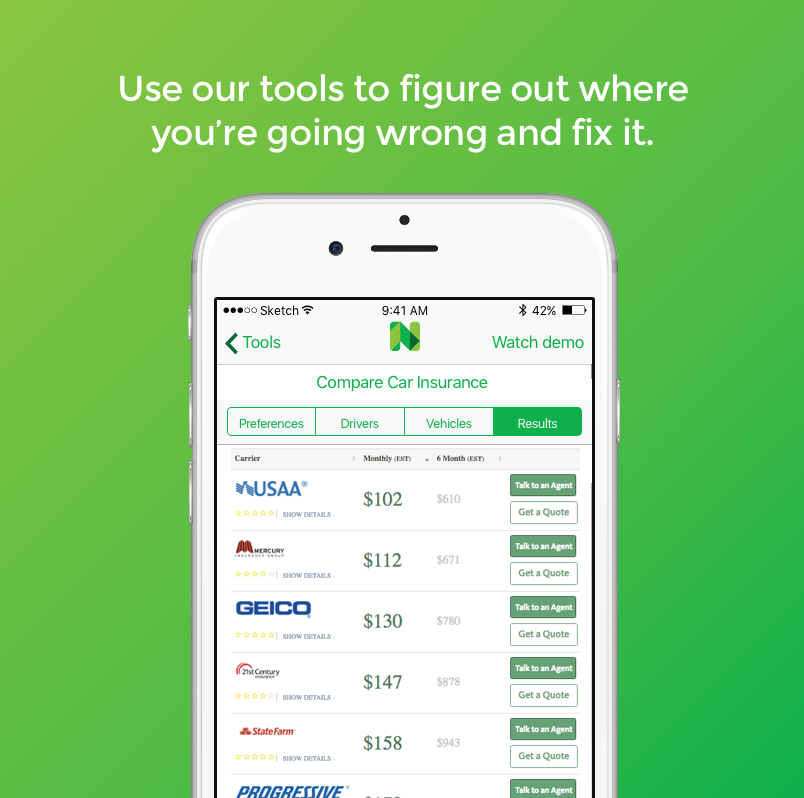

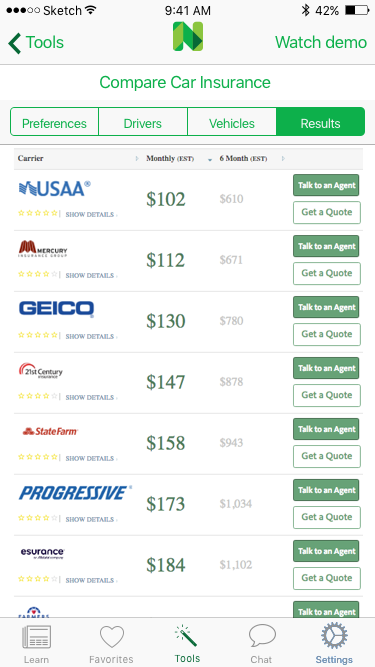

- easy access to all the comparison tools the company provides

- curating the content they see based on what's relevant for them (set through the Preferences section of Articles or through their profile in Settings)

- persistent / sequential guides to guide them to financial goal completion

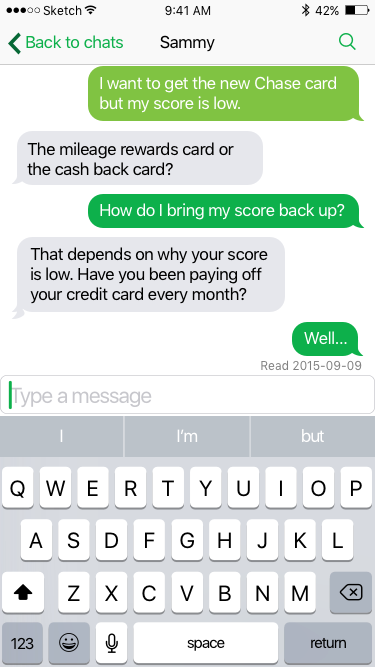

- records of chats they currently have with financial advisors on NerdWallet

NerdWallet would benefit from being able to:

- track which content users find valuable

- track where interactions/content pop up in the user's decision journey which could be licensed to banks for their own TOFU MOFU BOFU strategy (the equivalent of determining who's "sales ready" in a B2B sales cycle based on content consumed / # of touches)

- create better customer profiles based on user-provided data and preferences

- use better customer profiles to improve recommendations and personalize the UX (descriptive analytics becomes predictive analytics)

[SIDE NOTE: you could also use customer profiles and segments to create co-branded, personalized financial products in partnership with fintech startups—Earnest, Affirm, Wealthfront, Betterment, etc.—or large financial institutions. This is equivalent to Amazon using purchasing behavior to start producing its own branded products and Netflix creating its own content.

The business development team is probably licensing out this data to those companies for R&D since Nerdwallet is basically doing affiliate sales already.]

Measurement and testing

The Minimum Lovable Product to test interest in accounts would be (responsive) web accounts—NerdWallet doesn't appear to have a native iOS / Android team, and it would be much faster to get initial feedback from something they host rather than wait for app store approval. If they did develop the iOS app, though:

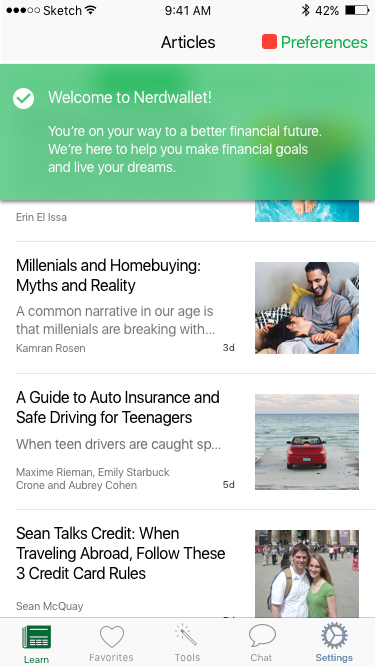

Users should get into the product and get value out of it without signing up. Onboarding screens could be designed, but a lot of research suggests they increase dropoff if they aren't used judiciously.

- The next priority is to gather profile info to power the recommendation engine. Nerdwallet can use that info in marketing and sell/license it to business development partners. Draw users' attention to the profile options and then spell out what value they'd get by creating a profile (and make use of the endowed progress effect by starting them off at 10-15%—the number is arbitrary but should be tested).

- The bottom tab bar's information architecture (which tabs appear and where) is based on the different ways users currently engage with Nerdwallet. The order right now is a best guess and should change based on usage.

- Badges/notifications along the bottom tab bar should be used to highlight new content as well as chat interactions.

Extra

NerdWallet can also fill out their Social Graph to appear more credible and established.

Is this actually a business? What do they do?